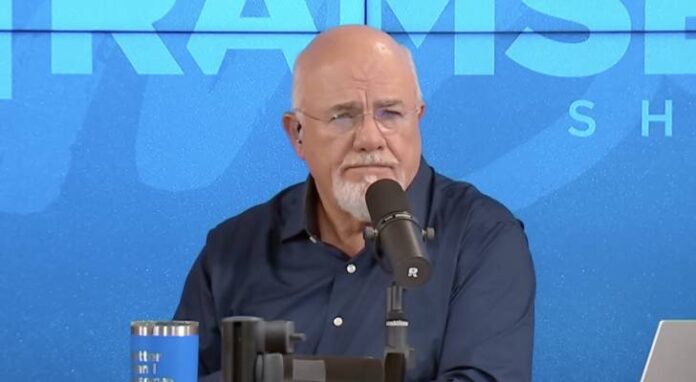

Finding yourself divorced at 51 after being a lifelong stay at home mom would make almost anyone feel overwhelmed figuring out how to take financial control of your life. That’s what happened to Trisha, who called into The Ramsey Show when her husband left after 22 years in 2022, (1) taking his $130,000 in annual income with him but leaving behind the new car he’d bought her the month before, which came with a $596 monthly payment.

Now that she’s had a few years to sort herself out, she’s looking to find a way forward. In addition to having to support herself, she is scared about retirement. She told hosts Ramsey and Jade Warshaw, “I spent my whole life raising kids, homeschooling. I have basically no retirement.”

But Ramsey says she can get back on track, even if she starts saving late. Here’s what to do if you find yourself struggling to make up for lost time when it comes to retirement savings.

Despite Trisha’s fear for her future, Ramsey was at ease, saying, “Your math is going to be OK. You’re gonna get there.”

Trisha told the hosts she had refinanced her car loan to save her money, started a second job, and had $38,000 saved in a money market fund, along with $3,000 in another account. With this fairly solid footing Ramsey recommended his 7 Baby Steps program, (2) his approach to building wealth.

These steps are:

Saving a $1,000 starter emergency fund

Paying off all debt (except the mortgage)

Saving three to six months of living expenses in an emergency fund

Investing 15% of your household income

Saving for college for your kids

Paying off your home early

Building wealth and giving

Ramsey went through the steps with Trisha, advising her to first pay off the remaining balance on the car, which was around $25,000.

“Write a check today and pay off the car,” he said. While he acknowledged this would be “very scary,” he also pointed out she would still have $16,000 left in savings, which was a good start to the emergency fund.

Since she already has an emergency fund, her kids have finished college and she rents her home rather than owns it, Ramsey concluded the only big thing left for Trisha to do was Step 4, investing 15% of her income.

She is earning $52,400 and has a second job that made $14,000 last year. She is also eligible for an employer match on her 401(k). Running the numbers, Ramsey felt confident that if Trisha invested 15% of her income from age 51 to 70, she’d end up with $600,000 to $800,000 — even if she never got another raise.

He left her with one key piece of advice: “You have to continue to be very process driven, math driven, and let the facts talk to you,” he advised. “You can fight through this. You can do it.”

Trisha’s fear about retirement isn’t unique. While 59% of Americans have a retirement account such as a 401(k) or IRA, only about half of them believe their savings will be enough to live on comfortably, according to a Gallup poll. (3)

And the balances don’t inspire much confidence. Vanguard’s 2025 How America Saves Report shows the average retirement account balance for Vanguard participants was $148,153, but the median balance — a better reflection of the typical saver — was $38,176. And even for those closest to retirement, the median balance was $95,642. (4)

That number may sound large, but under the common “4% rule,” it would generate less than $4,000 a year in retirement income. For someone like Trisha, the takeaway is clear: getting serious about consistent investing now can be the difference between scraping by and retiring with security.

Read more: Here are 5 simple ways to grow rich with real estate — whether you have $10 or $100,000 to invest

If you are behind on saving for retirement, or starting from scratch like Trisha, there are concrete steps you can take to catch up:

Determine your retirement number: A general rule of thumb is to aim for 10 times your final salary saved by retirement. For example, if you plan to retire earning $60,000 a year, you’d need about $600,000 saved. Use the calculator at Investor.gov to plug in your current age, expected contributions and time horizon to see what it will take.

Max out catch-up contributions: Workers 50 and older can contribute an additional $7,500 to a 401(k) in 2025, on top of the $23,000 standard limit. IRA holders can add an extra $1,000 to the $7,000 annual limit. These provisions are specifically designed for late starters.

Invest for growth: A diversified portfolio of stock index funds is key to building wealth over two decades. While bonds offer safety, equities provide the long-term growth you need if you’re starting late.

Delay retirement if possible: Working a few extra years can dramatically increase your nest egg by giving your investments more time to grow while also reducing the number of years you’ll need to draw down your savings.

Starting at 51 may feel intimidating, but as Trisha’s example shows, it’s not too late. With focused saving, smart investing and steady discipline, you can still build a meaningful retirement fund and reclaim control of your financial future.

Join 200,000+ readers and get Moneywise’s best stories and exclusive interviews first — clear insights curated and delivered weekly. Subscribe now.

We rely only on vetted sources and credible third-party reporting. For details, see our editorial ethics and guidelines.

The Ramsey Show (1); Ramsey Solutions (2); Gallup (3); Vanguard (4)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.