Corporate governance is central to the effective functioning of public sector undertakings (PSUs). To maximize board effectiveness, a careful balance must be maintained. The fourth edition of the Excellence Enablers’ survey explores corporate governance practices across 13 Maharatna and 20 Navratna companies.

Read this | Elusive gender diversity: PSUs the biggest culprits

Board composition plays a key role in governance. The Companies Act, 2013 mandates a minimum of three directors for public companies, two for private companies, and one for a one-person company, with a maximum of 15 directors. Over the past three years, the average board size of PSUs in the survey has remained stable, typically ranging from 9 to 13 directors.

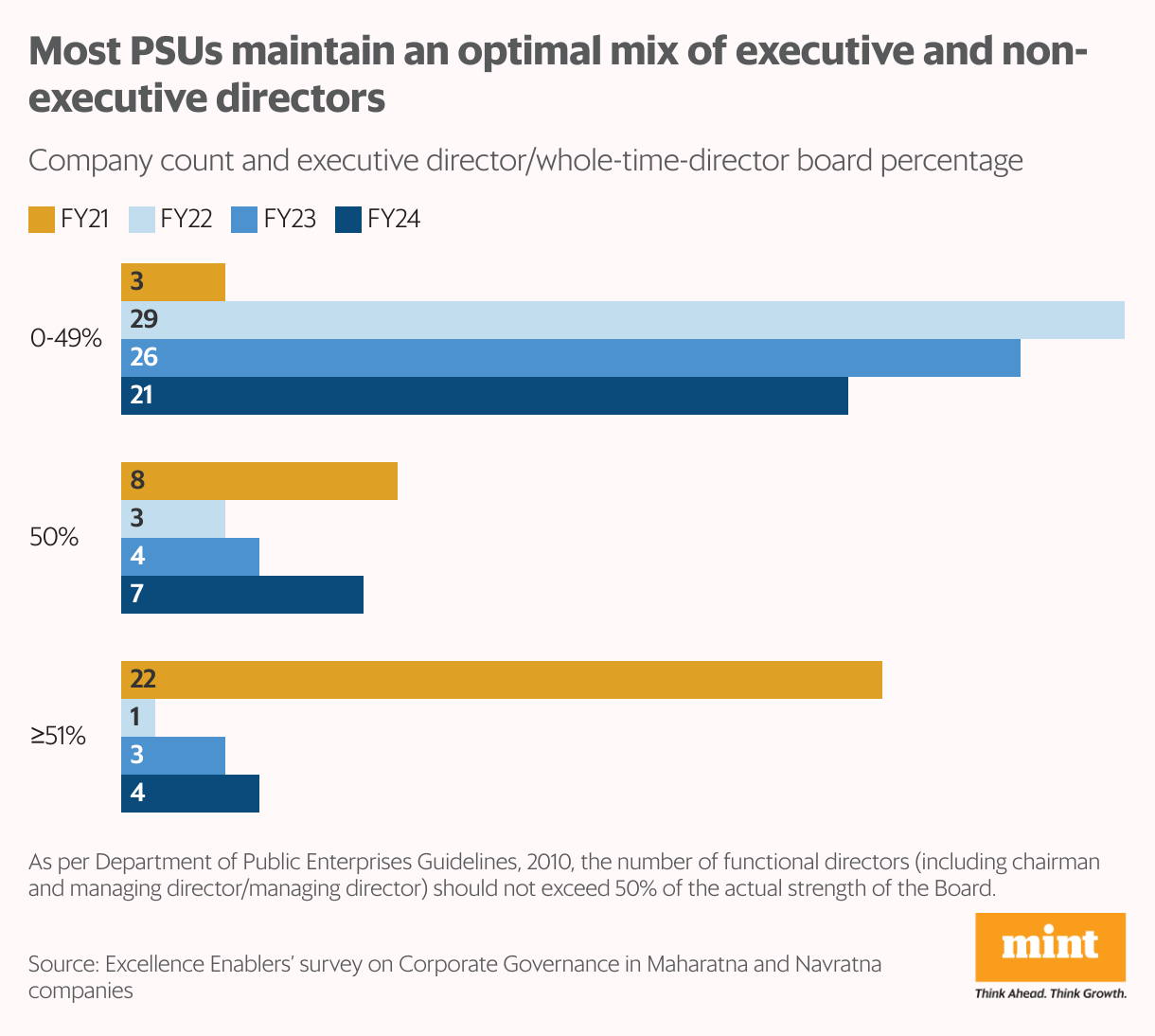

The Department of Public Enterprises (DPE) Guidelines, 2010, stipulate that functional directors, including the chairman and managing director (CMD) or managing director (MD), should not exceed 50% of the total board strength. The survey finds that most PSUs have been adhering to this balance, maintaining a mix of executive and non-executive directors.

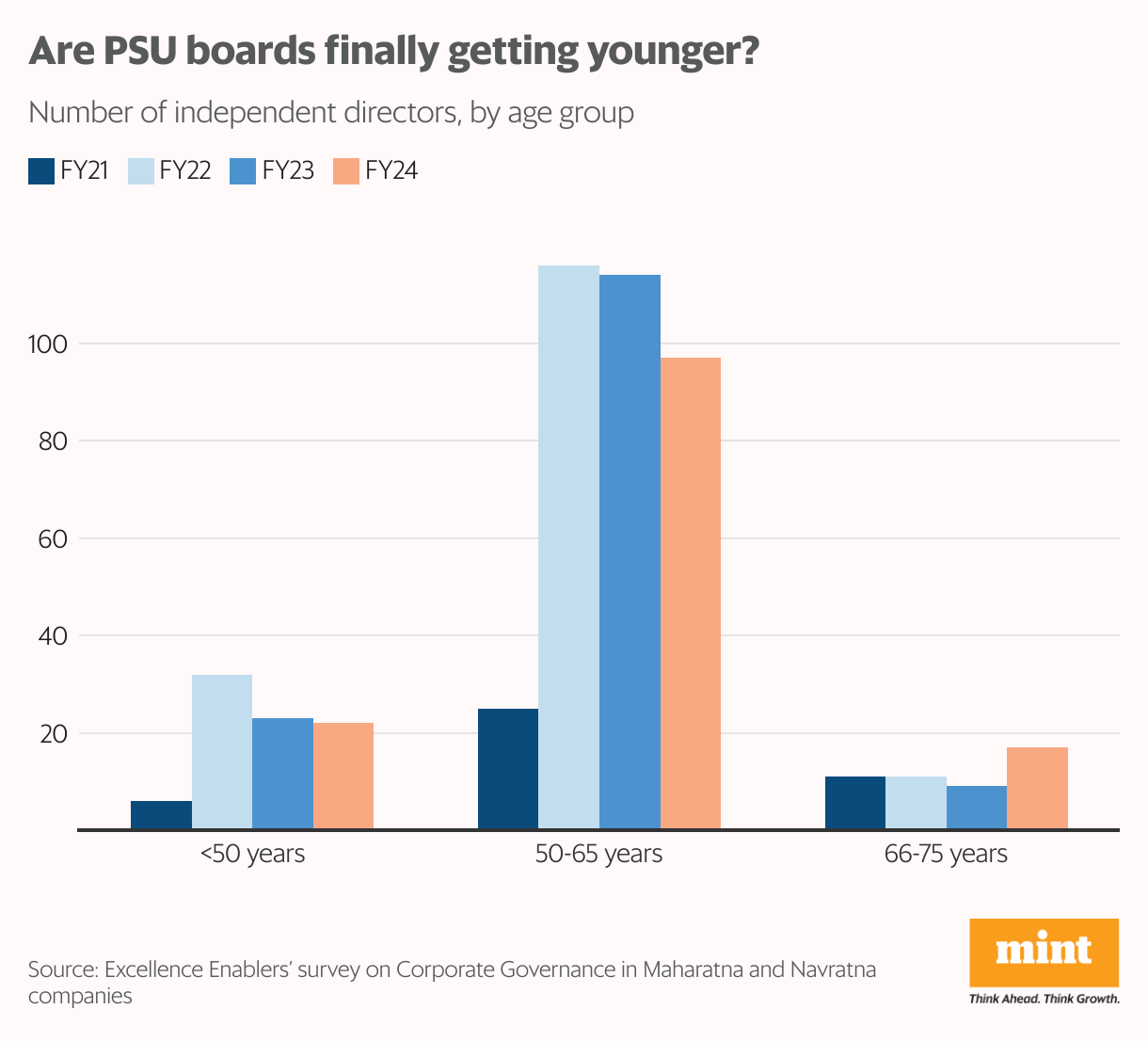

PSUs are also bringing in younger perspectives. While the number of independent directors under 50 fluctuated to 32 in FY22, it has risen from six in FY21 to 22 in FY24. This shift is notable, given that most independent PSU board members fall in the 50–65 age bracket.

Director tenure also influences board effectiveness. While long tenures can lead to stagnation, excessively short terms may limit meaningful contributions.

Read this | Former Sebi chief M. Damodaran calls for more regulatory impact assessment, better corporate governance

The average tenure for executive directors, including chairman and managing directors, has declined from 2.54 years in FY21 to 2.08 years in FY24. Independent directors are legally restricted to two terms of up to five years each, ensuring periodic board refreshment. For non-independent directors, including those up for reappointment, tenure should be long enough to allow meaningful contributions but not so long as to hinder fresh thinking.

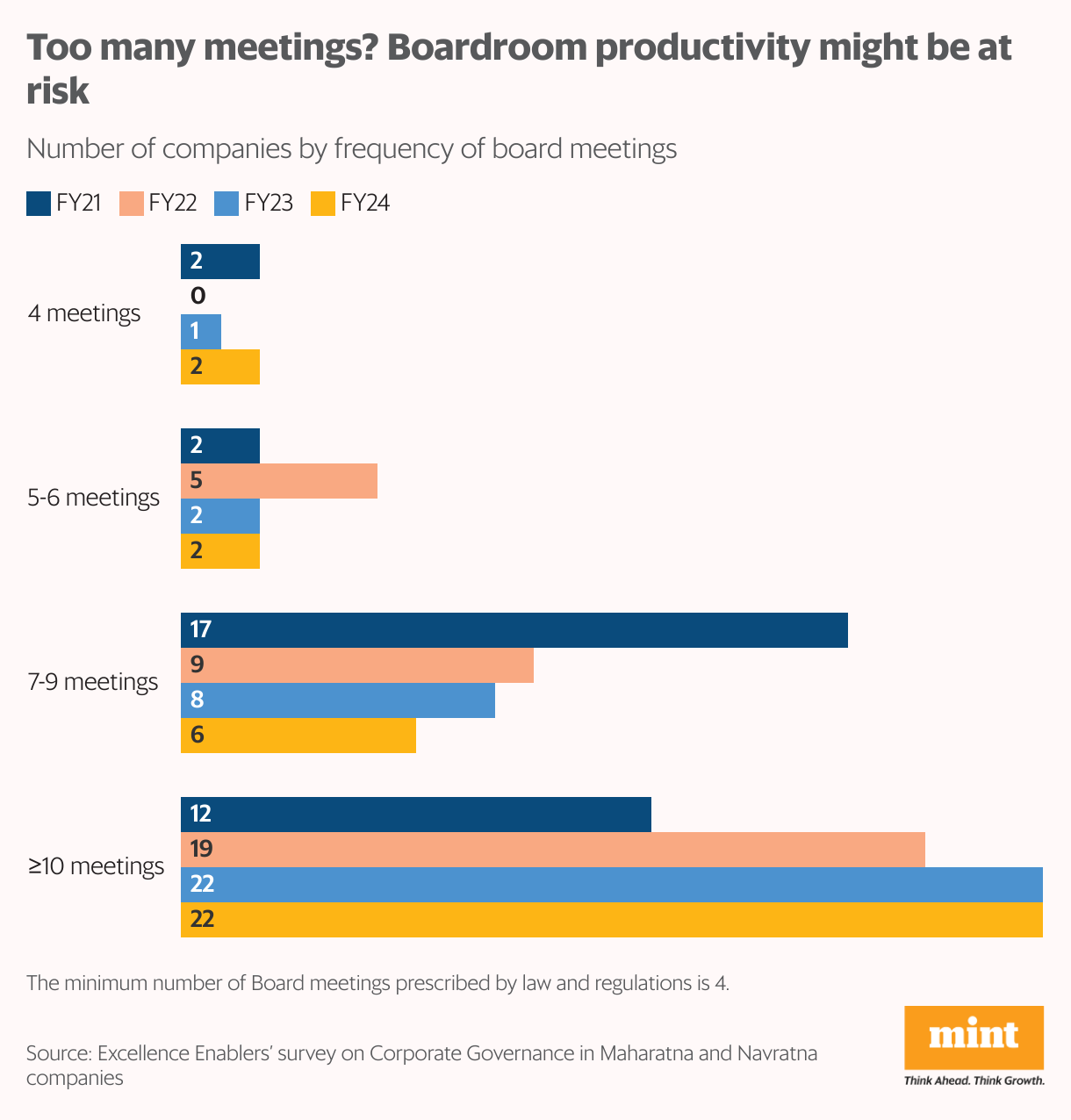

Board meetings are another crucial factor. While regulatory norms require at least four meetings annually, the survey finds that companies with at least six well-structured meetings derive greater value.

Also read | From bedroom to boardroom: How SaaS startup Wingify bootstrapped its way to success

However, excessive meetings can reduce efficiency and blur the lines between governance and management. The survey highlights that while most PSUs exceed the required number of meetings, too many can hinder productivity and risk managerial overreach.

Ultimately, a dynamic, balanced, and engaged board is essential for PSUs navigating today’s complex corporate landscape. Strong governance practices within select PSUs have often influenced broader regulatory frameworks, setting benchmarks for others in the sector.

Corporate governance,Public sector undertakings,PSUs,PSU board structure,Governance practices in India,Maharatna and Navratna companies,Board of directors in India,PSU regulations,PSU board effectiveness,Executive director tenure in PSUs,PSU corporate governance survey,Public sector board composition,Board diversity in Indian PSUs,Importance of corporate governance in public sector undertakings,How PSU board composition impacts governance effectiveness,Role of independent directors in Indian PSUs,Best corporate governance practices in government companies

#Balancing #boardroom #size #experience #tenure #shape #PSU #governance