Satpathy’s preferred snack of late is ‘Let’s Try Lite Multigrain Mixture’, which, to her mind, is healthy because it is made with groundnut oil. “I love it for its ‘no palm oil’ claim and the use of groundnut oil. It tastes great and is convenient since it’s available on all the quick commerce platforms,” she says.

Satpathy is one of a growing number of Indians who have become health conscious since the onset of the covid pandemic. These consumers watch what they eat, having become aware of the deadly toll junk food takes on the human body. When it comes to snacking, they look for ‘healthy’, guilt-free options.

That change in preference has triggered a seismic shift in the world of namkeen.

A host of new-age companies such as Farmley, Happilo, Evolve Snacks and Open Secret have been quick to capitalize on the shift in consumer preferences. From protein bars, makhana and quinoa puffs to oats bhujia and Ragi chips, these young brands are coming up with all kinds of products to reshape the way Indians snack.

In doing so, they have created a new category for healthy snacks. And so, what was once a niche market catering to a small segment of health-conscious consumers is now evolving into a mainstream movement.

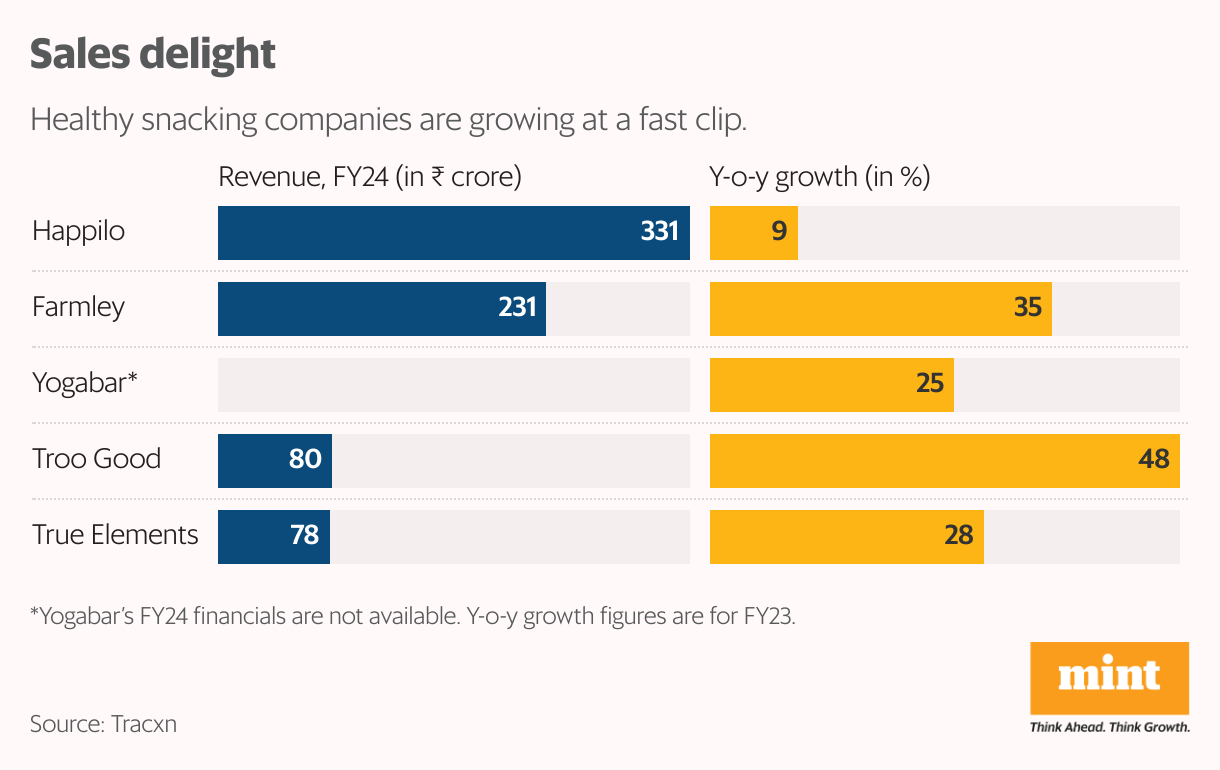

The numbers show just how quickly healthy snacking is growing as a segment. Happilo, the biggest of the new kids on the block, saw its revenue surge 80% to over ₹300 crore in FY23.

Rival Farmley raked in over ₹200 crore in revenue in FY24, registering a healthy 35% increase from the previous year.

Overall, the top five companies in the space witnessed 10-50% year-on-year revenue growth in FY24, according to data sourced from Tracxn. And that has made them ambitious.

Farmley and Happilo are now looking to become a ₹1,000 crore brand, while Open Secret wants to become at least a ₹500 crore company in the next 3-5 years.

Meanwhile, wary of the threat posed by the upstarts, legacy companies ITC, Marico and Tata Consumer have also been scrambling to ride the trend, albeit by taking the inorganic path.

Solving for price and taste

While some experts consider the term healthy snacking an oxymoron, insisting that there is no such thing, others beg to differ. Popular wisdom suggests that if a snack tastes great, it is generally bad for your health. And vice versa.

To be sure, the biggest challenge for snack makers is to crack that conundrum and create a product that is both tasty and healthy. Oil and sugar make a snack taste great, but in large quantities they wreak havoc on the human body. Without them, however, a snack is insipid.

“If you’re not tasty, or at least 95% as tasty as a Frito-Lay product or a Haldiram’s product [if you consider those tasty], you’re going to find it really difficult to create any kind of relevant business,” said Angad Sehgal, founder of Evolve Snacks, a healthy snacking company that sells namkeen and ragi chips, among other snacks.

And if a snack is somehow both healthy and tasty, it is expensive, as was the case with Open Secret’s first product: nutty cookies. As the company’s founder and CEO Ahana Gautam puts it, food is a trifecta of taste, health and affordability.

“In a cookie, maida is junk. We replaced it with dry fruits—50% of the product was just dry fruits,” said Gautam. “Now, maida comes at ₹30 per kg, whereas dry fruits are at ₹700 to ₹800 per kg. Of course, the product is going to be premium because the ingredients that we are using are expensive,” she said.

View Full Image

Price, acknowledges Harmanpreet Singh, an investor and founder of venture capital firm Prath Ventures, is a huge challenge. “In India, we don’t compromise. We want something that is both tasty and healthy, and that has always been difficult to manage,” he told Mint. “People have tried going the extreme route and saying this is the healthiest thing possible with no sugar, etc., but that also pushes up the price,” he explained.

Sehgal said that for certain products, Evolve Snacks started with a price point of around ₹50 for 50 grams, or ₹1,000 per kg. But then it started reducing the price because there was a realization that customers were buying the products out of novelty—there were no repeats. “We started bringing it down to ₹50, 40, 30 … a lot of testing happened on the price point. When we hit 20, we realized the volumes were really high,” said Sehgal. “India is a ₹20 market and will always be a ₹20 market. That much I can tell you for sure.”

Open Secret’s Gautam, like the other new-age entrepreneurs in the space, was chasing a lower price point and also ended up at the ₹20 mark. She achieved that by coming up with another biscuit that used millets, which cost about ₹90-100 per kg.

“We started with ₹35, where the customer used to get two biscuits. Now, millet biscuits will be ₹20 and you get five biscuits. As we scale, we will keep on making our products more affordable with new ingredients, procuring them at scale,” said Gautam.

Healthy snacking company Eat Better’s philosophy is taste first, says Shaurya Kanoria, its founder. “We don’t talk too much about health because whatever we are doing—our ladoos have about 95% dry fruits, we use millets to make namkeen, the namkeens don’t have any palm oil—all of that is very healthy,” he explained.

While acknowledging that the rise of healthy snacking is a positive trend, Tehseen Siddiqui, chief dietitian at Saifee Hospital in Mumbai, warned that even seemingly healthy snacks can be high in calories.

“Consumers should scrutinize the ingredient list. Just because a snack is labelled “healthy” doesn’t automatically make it so. For instance, many products have hidden sugars (like honey, agave, or fruit juice concentrate), excessive sodium, and unhealthy fats,” said Siddiqui.

Jostling for space

Tadaa, a relatively unknown healthy snack brand specializing in steamed, ready-to-eat sweet corn products, is finally hitting its stride. Founded in 2011 by Janardhan Swahar, a retail banker turned entrepreneur, the brand has almost doubled its year-on-year revenue in the last few years, thanks to consumers becoming health conscious.

“A customer who has been using our product for the last 5-6 years recently asked us if we can decrease the quantity of sodium in our product. After that person asked us, we reduced our sodium by half. Even though we had it in milligrams or less than milligrams, we reduced it further,” Swahar said. “The market is pushing us to make healthier products,” he noted.

Unlike Tadaa, Farmley, which started out as a dry fruits and nuts contract business for private label brands, transformed into a consumer brand only in 2021. Soon after, seeking to ride the trend towards healthy consumption, the company changed its positioning to become a wholesome snacking company.

“In the last three years, the market has grown immensely and some categories have almost doubled in size,” Akash Sharma, cofounder and CEO of Farmley, told Mint. “For example, flavoured makhanas is one category that has been growing very rapidly for us. Flaxseed mixes and healthy desserts are other categories that have been growing fast.”

Smaller outfits are also looking to get in on the action. Eat Better will close the year with a modest revenue figure of ₹25-30 crore. Taali Foods, led by Aarti Kochhar Kaji and Aditya Kaji, is another emerging brand. The company makes savoury snacks, primarily protein puffs.

View Full Image

While the startups are all focusing on building a sustainable business, none of them is profitable, as yet. Eat Better and Evolve Snacks are perhaps closest to that goal.

Eat Better reduced its losses from ₹1.2 crore in FY23 to ₹0.6 crore in FY24, on the back of 165% revenue growth, to ₹15 crore, according to data from Tracxn. Evolve Snacks narrowed its loss from ₹37 crore in FY22 to ₹0.3 crore in FY23, growing 80% in terms of revenue during the same period.

However, Open Secret, whose revenue grew 41% to ₹54 crore in FY24, saw its losses widen from ₹23 crore in FY23 to ₹25 crore in FY24.

Old guard cautious

While the new-age companies are going all out to turn health into wealth, traditional fast-moving consumer goods (FMCG) companies have proceeded cautiously and are yet to create a big brand for the category.

Rather than build a brand from the ground up, ITC, Marico and Tata Consumer have preferred the inorganic path, acquiring stakes in healthy snacking startups—respectively, Yogabar, True Elements and Soulfull, which are all focused on cereals—in the last few years.

“We are also seeing Gen Z and Millennials exhibiting a preference for guilt free and mindful snacking options,” said a Tata Consumer Products spokesperson. “There is significant opportunity for brands to innovate with product formats, packaging and communication.”

Noting that Tata Soulfull has seen revenues grow 4X since the snacking and mini meals brand’s acquisition by Tata Consumer in 2021, the spokesperson said that over the last two years, it has launched approximately 20 new products, across categories like breakfast offerings, mini meals and snacks.

Other FMCG players, including Marico, Britannia and Parle, did not respond to Mint’s queries.

The structure of these large organizations has been their primary constraint. “If they are launching a new product in 2024, they will start planning for it in 2022,” said Aditya Kaji. “But trends are moving so fast that, with that timeline, I don’t think you really know what works anymore for brands like ours.”

Concurring with that assessment, Kanoria said startups are faster and understand the customer as they’re closer to the customer. FMCG companies or larger companies have been very good at coming in and disrupting markets or creating brands where there are clearly established product lines, clearly established supply chains, and the scale is very large, he said.

Rather than build a brand from the ground up, ITC, Marico and Tata Consumer have preferred the inorganic path, acquiring healthy snacking startups.

Taking the quick route

Quick commerce has accelerated the growth of new-age brands, which would have been impeded if their presence was limited to offline stores or traditional e-commerce.

Snacking is a highly impulse-driven category and traditional e-commerce can’t really scratch that itch. Quick commerce, however, satisfies it almost instantly. “When viable channels open up, that’s when new brands get built,” said Prath Ventures’ Singh. Quick commerce platforms have been pushing a lot of newage healthy snacking brands, because of their higher margins, Singh added.

The platform also provides real-time data and throws up a lot of insights, said Open Secret’s Gautam. “It’s just so much rich data, which can really help you build the right strategies, build the right products,” she added. More than 50% of Eat Better’s business comes from quick commerce, while about 35% comes from e-commerce marketplaces and the rest from its website or offline channels.

The larger market is still offline. The legacy crowd rules the roost there and the terrain is rough for newcomers. “It is very difficult to place your products in physical retail. The payment cycles are very long and it’s very difficult to collect money,” said Kanoria. “The terms that you generally get are not very favourable and it’s very difficult to manage those operations as it’s a very manpower-heavy business.”

Bucking the trend, Taali Foods chose to launch offline first, with the channel making up about 80% of its business. However, the founders concede that the offline market is difficult, especially for a startup. “The first thing you get asked is, what kind of margin are you going to offer? It’s very, very difficult to set up an offline business,” Aditya Kaji told Mint.

With quick commerce, said Singh, “you can delay your offline entry, so you can probably reach the ₹100 crore scale without really entering that space”. This also paves the way for an offline entry later. “If your product is good, your brand is now visible and has penetrated into so many households then even offline partners will look at it differently,” he added.

Indeed, building an offline presence may be critical for new-age brands in their next phase of growth, as the general trade (mostly kirana shops) accounts for 90% of the market, say experts.

In the larger context, while they will encounter many challenges in the push to build scale, companies making healthy snacks will also benefit from some tailwinds. Growth capital could be easier to raise with brands in the space drawing interest from investors. Social media content also favours healthy snacking, especially with influencers telling people to read labels before making a purchase.

All in all, the healthy snacking market is an exciting space primed to see a lot of action, with consumers in the thick of it. As Tadaa’s Swahar put it, “Many habits are dying out. People have started working out and eating better. It is a paradigm shift.”

snacks,Farmley,Happilo,startups,Health,snacking,healthy snacks,Open Secret,quick commerce

#Health #wealth #startups #legacy #companies #milking #demand #nutritious #snacks