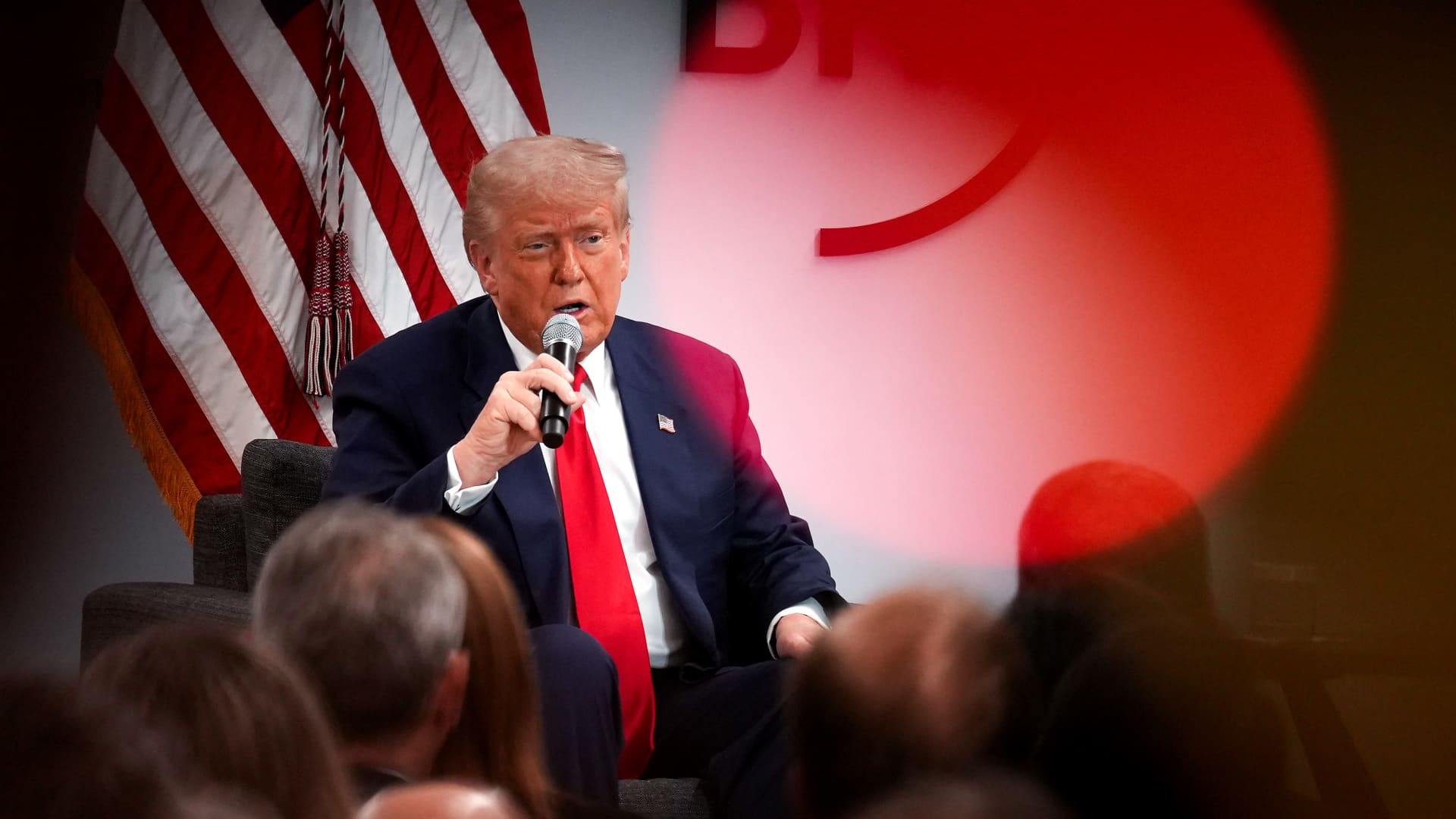

Andrew Harnik | Getty Images

Three months later, some may be asking whether the famously transactional president has their backs. Many of those corporations have had their businesses roiled by Trump’s tariff policy and resulting consumer caution, dampening the optimism much of the business and finance community felt when he was reelected.

Some of the nation’s largest companies, including General Motors, BlackRock and Meta, donated to Trump’s inaugural committee, leading it to raise a record $239 million – more than the previous three inaugural committees took in combined, according to filings released Sunday.

Presidential inaugural committees are set up as charitable organizations, and the money they raise has traditionally funded parades and galas around the president’s formal swearing in. Unlike presidential election campaigns, there is no set limit on how much a corporation or U.S. citizen can give to an inaugural committee. (President Joe Biden did not have traditional inaugural events in 2021 due to the Covid pandemic).

This makes inaugural donations an early opportunity for companies to publicly show support for the incoming president. And in Trump’s case especially, to ensure that the company has a seat at the table as policy decisions are being made.

Inaugural committees must disclose their donors, but they are not required to disclose how they spend the money. After raising hundreds of millions of dollars more than it costs to put on three balls and an indoor parade, the Trump inaugural committee is expected to put the rest toward Trump’s eventual presidential library.

Some of this year’s donors, like Target, McDonald’s and Delta Air Lines, hadn’t contributed to an inaugural committee in more than a decade. Others including Pfizer, Walmart and Visa were regular contributors, as they donated the same amounts in 2025 that they did in 2021 and 2017.

What just about every donor had in common was they wrote their checks at a time when the business community was still riding high on the president’s victory. Consumer confidence was surging, Trump had promised tax cuts were coming and triple-digit tariffs on critical trading partner China weren’t part of the conversation.

But in the weeks and months since, many of those same corporations have seen their businesses upended by Trump’s economic policies, which have centered on tariffs that economists from across the ideological spectrum have warned could raise costs for consumers and tip the economy into a recession.

“The expectation was because the last administration was very, very difficult for business, very, very difficult to engage and to communicate broadly across all industries, the expectation was that this would be improved,” Goldman Sachs CEO David Solomon said on CNBC’s “Squawk Box” on Tuesday. “There are certain things that have been put forward from a policy perspective that, you know, that don’t feel in line with the expectation people had.”

While Trump and key administration officials have given signals they could soon reduce the tariffs on Chinese imports, sending stock markets higher, there’s no guarantee they will strike a deal to do so.

Companies mentioned in this report either did not respond to requests for comment, declined to comment or highlighted their past support for inaugurations for both political parties or policies they consider good for business.

Beyond corporations, many of the individuals who contributed to Trump’s inauguration are now working closely with the White House or shaping policy.

Sam Altman, the CEO of OpenAI, donated $1 million to the inauguration. He is now working on the Stargate Project, a collaboration between OpenAI and the government to build AI infrastructure in the U.S.

Jared Isaacman, Trump’s nominee for NASA administrator, donated $2 million to the inauguration. Treasury Secretary Scott Bessent gave $250,000.

Here’s a closer look at the ways various industries contributed to Trump’s inauguration and how those businesses are faring three months into his administration.

Tech

The tech industry’s biggest companies — and many of their CEOs — lined up to donate to Trump’s inaugural fund as part of a targeted effort at creating a friendlier relationship with the White House after a tumultuous four years during Trump’s first term.

Amazon founder and former CEO Jeff Bezos was another frequent Trump target, largely due to his ownership of the Washington Post, and he too has rushed to appease the president this time around.

Meta and Amazon each donated $1 million to the inaugural fund, as did Google and Apple CEO Tim Cook. Microsoft and Adobe kicked in the same amount. So did AI infrastructure players Nvidia and Broadcom. Uber did the same.

Across the industry, companies were hopeful that a second Trump administration would lighten up on regulations following a burdensome era under Biden, when IPOs ground to a halt and big merger efforts were quashed.

The industry is now getting hammered by Wall Street on concern that a combination of higher import costs and reduced business spending will dramatically shrink profit margins. For Meta and Google, the primary issue is the potential for advertising budgets to dwindle, but there are other challenges that permeate the entire industry.

The tech giants have been loading up on Nvidia chips and other hardware to build out their infrastructure for the AI boom. Those products are all subject to various tariffs, particularly goods coming from China and Taiwan. While Trump said there will be an exemption for phones, computers and chips, the administration later indicated that there would be separate tariffs for those products.

And when it comes to regulations, Google and Meta are currently in court for antitrust cases. Trump’s Federal Trade Commission on Monday filed suit against Uber, accusing the ride-hailing and delivery company of deceptive billing and cancellation practices tied to its subscription service.

— Ari Levy

Food and beverage

With a $5 million donation, poultry giant Pilgrim’s Pride was the top contributor to Trump’s inaugural fund. Brazilian meat giant JBS, Pilgrim’s largest stakeholder, is awaiting approval to go public through a dual U.S.-Brazil listing as it faces opposition from environmentalists, U.S. beef producers and lawmakers from both sides of the aisle.

More broadly, the meat industry has been pushing Trump to roll back regulations, which his administration did during his first term.

Beyond big meat, McDonald’s gave to the presidential inauguration for the first time in more than a decade with its $1 million donation. While the fast-food chain is one of Trump’s favorite caterers, McDonald’s could face scrutiny from Health and Human Services Secretary Robert F. Kennedy Jr., who has pledged to “Make America Healthy Again.” Kennedy has started by taking aim at artificial food dyes, but fast food could be on the list; he recently praised Steak ‘n Shake for using beef tallow to cook its fries.

The uncertainty of tariffs and growing recession fears could also weigh on McDonald’s sales, if consumers cut back on their Big Macs and McNuggets. Over the last year, the company has already seen U.S. sales struggle as diners cut back on eating out.

Fat Brands, which owns Fatburger, Johnny Rockets and more than a dozen other restaurant chains, donated $100,000 to the inaugural fund. Last year, the company and its chair Andy Wiederhorn were indicted over what prosecutors called a “sham” loan scheme that netted him $47 million, allegations he and the company deny.

Trump reportedly personally fired the assistant U.S. attorney leading the case against Fat Brands and Wiederhorn in March. However, Justice Department officials in California told The Oregonian that the prosecution will continue.

On the beverage side, spirits giant Diageo chipped in $125,000 in in-kind donations of beverages. While the Johnnie Walker and Don Julio owner is facing higher tariffs for some of its brands, its Mexican tequila and Canadian whisky are exempt because of the U.S.-Mexico-Canada trade agreement.

Coca-Cola and PepsiCo, both regular contributors to presidential inauguration funds, wrote checks this year as well. Both beverage companies are under fire by Kennedy’s MAHA agenda, which is pushing states to seek bans on using federal food assistance to buy soda and junk food. The American Beverage Association, a trade group that counts Keurig Dr Pepper among its members, also chipped in $250,000.

— Amelia Lucas

Retail

The retail industry was one of the only sectors that had a dour outlook after Trump was elected because of the acute impact tariffs can have not just on their supply chains, but also on consumer confidence and spending.

That could be why both the National Retail Federation, the industry’s lobbying arm, and big box giant Target contributed to the inauguration committee for the first time in at least a decade.

The NRF gave $250,000 to the fund, while Target wrote a check for $1 million.

Since Trump was elected, and even before, the NRF has been sounding the alarm about the impact tariffs will have on consumers and its retail members, calling the duties a tax on American families.

Target is more exposed to tariffs than its longtime rival, Walmart, because more of its sales come from discretionary goods like clothes and home goods that tend to be manufactured overseas. The discounter’s annual sales have been roughly flat for four years in a row and last month, Target said it expects sales to grow only 1% for this fiscal year.

Target has also felt the heat from conservative groups in recent years, and from shoppers and potential customers who have shown support for the administration and its policies. Earlier this year, Target rolled back its diversity, equity and inclusion efforts soon after Trump vowed to dismantle every DEI initiative across the federal government.

The retail industry has lobbied the Trump administration to take a common sense approach to tariffs and stressed it will be difficult, if not impossible, to move some manufacturing jobs back to the U.S. Yet it remains unclear if that push will work — especially when the 90-day tariff pause ends in countries outside of China that have become key manufacturing hubs, such as Vietnam.

The best the industry has achieved so far was a meeting at the White House on Monday between Trump and the chief executives of Walmart, Target and Home Depot.

After the meeting wrapped, the three companies issued nearly identical statements.

“We had a productive meeting with President Trump and our retail peers to discuss the path forward on trade,” Target said. “We remain committed to delivering value for American consumers.”

Walmart contributed $150,000 to the inaugural committee for Trump. But the Arkansas-based retail giant has donated the same amount for the past three inaugurations — including Biden’s in 2021 and Trump’s first in 2017.

— Gabrielle Fonrouge and Melissa Repko

Health care and pharmaceuticals

The pharmaceutical industry and some health-care companies shelled out big for Trump this time around. While Trump has maintained his focus on curbing high health-care costs, the pharmaceutical industry was banking on a softer stance on drugmakers, or at least a more open ear to their concerns about Biden-era policies that cracked down on prescription drug costs and aimed to increase industry competition.

Now, drugmakers are bracing for Trump’s proposed pharmaceutical tariffs and grappling with uncertainty around the sweeping overhaul of federal health agencies under Kennedy, a prominent vaccine skeptic. But Trump offered the industry some reprieve last week: He signed an executive order targeting a law that allows Medicare to negotiate drug prices, proposing changes long sought by pharmaceutical companies.

PhRMA, the industry’s powerful trade association, and leading drugmakers including Pfizer, Merck, Johnson & Johnson, Gilead and Bayer each gave $1 million, while Eli Lilly contributed $500,000.

All were first-time donors except for Pfizer, which contributed $1 million to both Biden’s 2021 and Trump’s 2017 inaugurations.

Vaxcyte, a small clinical-stage vaccine maker, also donated $1 million for the first time. The move may reflect growing concern among vaccine makers over Kennedy’s leadership, which already appears to be impacting U.S. vaccine policy.

Amgen has a track record of bipartisan support, contributing $500,000 to this year’s inauguration as well as the previous two. Medical device maker Abbott Laboratories also gave $500,000 this year, a notable increase from its contributions in 2021 and 2017.

Outside of the pharmaceutical industry, telehealth company Hims & Hers Health contributed $1 million as it seeks support for its compounded medications, which have faced backlash from weight loss drugmakers like Eli Lilly.

Health-care companies HCA Healthcare, Molina Healthcare and Blue Cross Blue Shield contributed small amounts for the first time. All three insurers offer Medicare Advantage plans. Insurers in that market have been lobbying Trump to pursue lighter regulations for those privately run government programs.

Centene, which provides government-sponsored health plans, was an outlier, contributing just $50,000 this year. That’s far less than its previous donations of $500,000 to Biden in 2021 and $250,000 to Trump in 2017.

— Annika Kim Constantino

Finance

The biggest players in American finance pumped more money into Trump’s coffers this year than they did for previous inaugurations, while lobbying aggressively for sweeping deregulation across traditional and cryptocurrency markets.

JPMorgan Chase and Goldman Sachs, the biggest U.S. retail bank and one of the most powerful Wall Street firms, respectively, each gave $1 million to the Trump inauguration, compared with nothing for Biden’s in 2021.

Capital One, which hadn’t donated in the two previous election cycles, gave Trump’s inaugural committee $1 million. The bank at the time was seeking approval for its $35 billion acquisition of Discover Financial, announced in early 2024 and finally greenlit last week.

The same is true for BlackRock and Blackstone, the twin titans of the asset management universe, which each gave $1 million to the inauguration fund after not donating in the two previous election cycles.

The stakes for banks were high. JPMorgan CEO Jamie Dimon has repeatedly complained about the “regulatory assault” from Biden-era banking regulators that would hit revenue by tens of billions of dollars and add capital requirements for the biggest U.S. banks.

Dimon and others, including bank trade groups, fought back against efforts to increase capital requirements on the industry, dubbed the Basel III Endgame. They also opposed a series of Consumer Financial Protection Bureau rules designed to limit overdraft and credit card late fees.

Thanks to the takeover of the CFPB by Trump pick Russell Vought and the nomination of Michelle Bowman as Federal Reserve vice chair for supervision, it appears banks will get much of what they hoped for. Vought has dropped a string of high profile legal cases against banks and other financial firms while attempting to shutter the agency, while Bowman is considered to be friendly to the industry.

But financial firms have more pressing issues these days. Concerns that Trump’s aggressive trade policies will start a recession have hammered financials in recent weeks, pushing the KBW Bank Index into a bear market decline of 20% from its post-election high.

Shares of Blackstone were hit even more, down about 38% from their November 2024 high, on concerns that tariff uncertainty will make it hard for the private equity industry to sell its portfolio companies.

Crypto players also gave generously. Robinhood contributed $2 million to the inaugural committee after not donating in the two previous elections, while the Coinbase founder and his company gave a combined $2 million.

The industry has already benefited from a loosening of restrictions around cryptocurrency and banking spurred by the Trump administration, and legislation is progressing that will allow more players to offer stablecoins to retail customers.

— Hugh Son

Airlines and aerospace

Delta and United, which each gave $1 million to the Trump inauguration, are cutting their domestic capacity plans this year due to weaker demand, particularly from the economy cabin. (About $250,000 of United’s contribution was an in-kind donation of flights).

Months earlier, in November, Delta CEO Ed Bastian said that the incoming Trump administration would likely be a “breath of fresh air” in terms of regulation after Biden’s Transportation Department. During Biden’s administration, the DOT issued a host of new rules aimed at protecting consumers from airline fees and ensuring they get refunds if flights are delayed or canceled.

Earlier this month, Bastian took a different tone on the administration when the carrier reported quarterly earnings. In an interview, Bastian called Trump’s tariff policy “the wrong approach” and said it hurt bookings, leading Delta to pull its 2025 earnings forecast.

Boeing, which also gave $1 million to the Trump inauguration, is the nation’s top exporter and is once again caught in trade conflicts, none more pronounced than the tit-for-tat tariffs with China.

Boeing’s CEO Kelly Ortberg said Wednesday that China has stopped taking deliveries of its aircraft amid the trade war. He said the company could hand over some of the airplanes that were destined for Chinese airlines to other customers this year.

While Boeing makes its aircraft in the United States, the company and the manufacturers of large aircraft parts like engines and wings rely on a global supply chain that could be impacted by a broad-based 10% tariffs on much of the world that Trump imposed earlier this month, as well as duties on imported aluminum and steel.

Major aerospace suppliers are also in the crosshairs of the trade war. Even if they produce their exported products in the U.S., companies are reliant on a global supply chain that’s still fragile from the Covid-19 pandemic and could be impacted by tariffs. Foreign companies producing goods in the U.S. are also affected, like Airbus, which assembles some of its narrow-body planes in Alabama, but relies on imports.

GE Aerospace CEO Larry Culp met with Trump and other White House officials this month and said he suggested that the industry be able to go back to the mostly duty-free trade it’s enjoyed under a 45-year-old agreement.

“We have suggested, as the administration works through a myriad of issues, is that they can consider the position of strength that the country enjoys as a result of this tariff-free regime and to consider reestablishing the same,” said Culp.

RTX and GE Aerospace, a defense contractor and commercial aerospace supplier, respectively, estimated Tuesday that higher expenses from tariffs will cost their businesses more than $1 billion combined. GE said it will offset $500 million with corporate cost cuts and price increases.

— Leslie Josephs

Autos

American-based automakers such as Ford Motor and General Motors have contributed to inaugurations in the past, but they increased their donations from hundreds of thousands of dollars to $1 million or more, including vehicles, for Trump’s inauguration this year.

GM, Ford and the North American operations for Chrysler parent Stellantis each donated at least $1 million to this year’s inauguration. Ford, as disclosed in Sunday’s filing, also provided roughly $200,000 in vehicle services as in-kind donations. GM provided vehicles as well, but the monetary value was not immediately available.

In addition to the traditional “Detroit automakers,” foreign-based companies Hyundai Motor and Toyota Motor also donated $1 million to the fund through their American operations, after not contributing to the past two inaugurations.

In total, the automotive sector donated roughly $5.3 million to Trump’s inauguration, including $100,000 from Schumacher Automotive, a dealer group based near Mar-a-Lago in West Palm Beach, Florida.

Since the inauguration, Trump has caused what some, such as Ford CEO Jim Farley, have described as “chaos” around automotive tariffs and inconsistent messaging around the levies. The industry is currently dealing with 25% tariffs on materials such as steel and aluminum, as well as 25% levies on imported vehicles from outside of the U.S. Tariffs on automotive parts imported into the U.S. are also set to take effect by May 3.

The new levies were introduced and implemented swiftly, making it difficult for the automotive industry to plan, especially for expected increases in the cost of auto parts.

Many smaller suppliers are not equipped to change or move manufacturing operations quickly and may not have the capital to pay for tariffs, potentially causing stoppages in production.

“Most auto suppliers are not capitalized for an abrupt tariff induced disruption. Many are already in distress and will face production stoppages, layoffs and bankruptcy,” six of the top policy groups representing the U.S. automotive industry wrote in a letter to Trump administration officials. “It only takes the failure of one supplier to lead to a shutdown of an automaker’s production line. When this happens, as it did during the pandemic, all suppliers are impacted, and workers will lose their jobs.”

The statement followed Trump saying he may “help” some auto companies who need more time to move production or find new suppliers, but he has not announced any actual plans since then.

— Mike Wayland

Breaking News: Markets,Trade,Politics,Breaking News: Politics,Economy,Breaking News: Economy,Airlines,Business,Retail industry,Breaking News: Business,Markets,Alphabet Inc,Jeff Bezos,Jeff Bezos,Amazon.com Inc,Broadcom Inc,Apple Inc,Microsoft Corp,Adobe Inc,NVIDIA Corp,Mark Zuckerberg,Mark Zuckerberg,McDonald's Corp,Goldman Sachs Group Inc,Visa Inc,Walmart Inc,Pfizer Inc,Delta Air Lines Inc,Target Corp,Donald Trump,Donald J. Trump,Meta Platforms Inc,BlackRock Inc,General Motors Co,Uber Technologies Inc,Pilgrims Pride Corp,Diageo PLC,Diageo PLC,Coca-Cola Co,PepsiCo Inc.,Keurig Dr Pepper Inc,Home Depot Inc,Merck & Co Inc,Johnson & Johnson,Gilead Sciences Inc,Bayer AG,Bayer AG,LILLY DRN,Amgen Inc,Abbott Laboratories,JPMorgan Chase & Co,Capital One Financial Corp,Discover Financial Services,Blackstone Inc,Robinhood Markets Inc,Coinbase Global Inc,General Electric Co,Ford Motor Co,Stellantis NV,Stellantis NV,Hyundai Motor Co,Hyundai Motor Co,Toyota Motor Corp,Toyota Motor Corp,United Airlines Holdings Inc,business news

#Trump #inauguration #donors #include #Meta #Amazon #Target #Delta #Ford