At first glance, a 54% month-on-month drop in sales is alarming in a sector targeting individual consumers. But, seen in totality, marked drop-offs in December are par for the course for the Indian two-wheeler sector. November tends to be the sector’s best month. Sales spike because of the festive season, and then it is about a reversion to the mean. This time around, November was exceptional, giving the sector reasons to feel good—but also some to be circumspect about for 2025.

In calendar 2024, about 18.9 million new two-wheelers were registered, shows government data. That makes it first year the sector registered more two-wheelers than the 18.65 million units in 2019, the last year before the onset of the covid-19 pandemic and its considerable cascading effects. While four-wheelers managed that overhaul in 2021 itself, the claw back for two-wheelers has been staggered. Now, there’s a new baseline.

November 2024 was the best month for two-wheelers in the six-year period between 2019 and 2024. About 2.62 million two-wheelers were registered, which was 16% higher than the next-best month, in November 2023. That spike is partly the reason why the November to December drop off, which was 36-39% in 2022 and 2023, rose to 54% in 2024—the highest in the last six years. Each of the top 10 two-wheeler companies in the last saw a drop off in December, ranging from 19% (Ather) to 64% (Hero MotoCorp). Will the sector see a usual reversion to mean and build on its 2024 gains?

Also Read: 2025 will be the year of EVs for India, say automakers at Bharat Mobility Expo

Electric Order

The sector needs to press all levers it can to sustain the 10-12% annual growth of the last three years. One of those levers of promise, though undelivered, is electric vehicles. Bhavish Aggarwal, who leads Ola Electric, had predicted the demise of new two-wheelers run on petrol by end-2025. That is not going to happen. Of the 18.9 million new two-wheelers registered in 2024, only 1.14 million were electric. Or, about 6%.

Electric did grow faster on that smaller base—33% against 9.6% for non-electric in 2024. As electric grows, so are traditional manufacturers in the segment. In electric, the top five manufacturers had a combined market share of 87% in 2024. In the latest October to December quarter, which also covered the festive season, TVS Motors and Bajaj Auto—better known for their petrol two-wheelers—made the maximum gains in share. Market-leader Ola, a pure electric play, saw its share drop.

Also Read: Will Ola Electric Mobility’s motorcycle bet pay off?

Exports Track

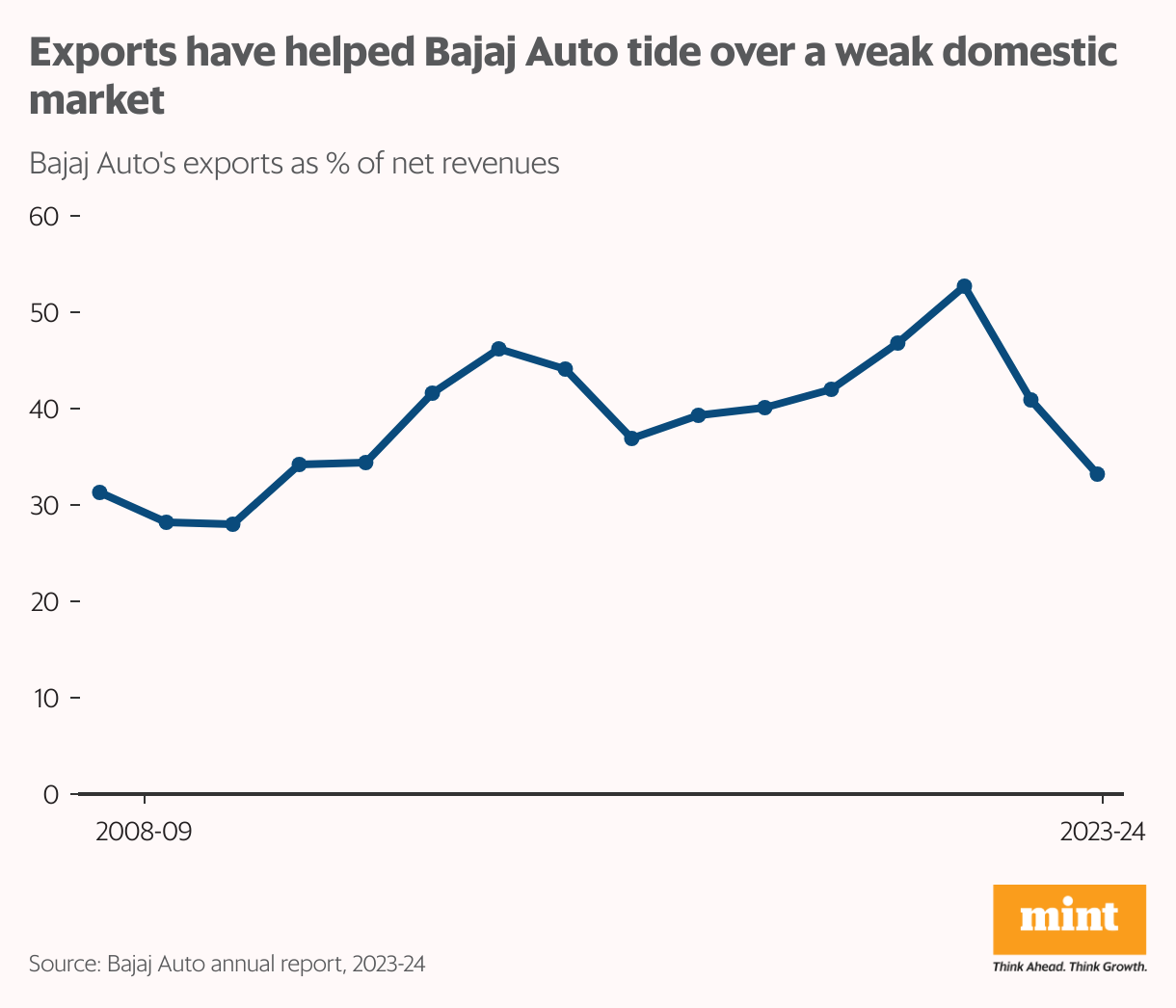

Exports is another growth lever. Bajaj Auto has worked assiduously to build this piece for itself. In the six-year period between 2018-19 to 2023-24, it averaged exports of 1.78 million vehicles against average domestic sales of 2.02 million vehicles. Post-covid, when the domestic two-wheeler sector shrunk in size, Bajaj managed to increase exports. As a result, the share of exports in its overall revenues crossed 50% in 2021-22. In contrast, in 2023-24, when domestic sales were strong, its export share fell to about one-third.

Similarly, exports accounted for 24% of TVS Motor’s revenues in 2023-24. However, it’s a tough market to crack, having many moving parts that Indian manufacturers don’t have to deal with in the domestic setup. In its 2023-24 annual report, Bajaj Auto talks about navigating “continued rough macro-economic conditions across its key markets”, including currency constraints and market volatility.

Also Read: Policy tweaks drag sale of subsidized electric two-wheelers to three-year low

Base Effect

Five of the top 10 two-wheeler manufacturers are listed on the stock market. Their stock performance over the medium term and short term offers some window to the market. Over a five-year period, barring Hero MotoCorp, the other three listed for that duration—Bajaj, TVS and Eicher (which houses Royal-Enfield)—have all outperformed the market handsomely. But in the last six months, Hero and Bajaj have trailed the market. As has Ola.

Could the two-wheeler industry follow its four-wheeler cousin in feeling the burden of the high base effect and taper off? On the rural front, in all months from May to October, the rural employment guarantee scheme—some measure of rural distress—saw fewer person days of employment compared to the corresponding month of 2023-24. That changed in November and December, when it saw year-on-year growth of 9% and 13%, respectively. The baseline has moved for the two-wheeler sector. Can it keep up?

www.howindialives.com is a database and search engine for public data

Two-wheeler sales,covid-19,Hero MotoCorp,Ola Electric,TVS Motors,Bajaj Auto,four-wheelers,electric Two-wheeler

#twowheelers #stay #pedal