The 18th edition of the cash-rich Indian Premier League kicks off in a week’s time at Eden Gardens, Kolkata. In the 2024 season, streaming partner JioCinema had recorded a 57% growth in IPL viewership compared to the previous year. The unceasing popularity of the game over the years has attracted investments of crores of rupees from stakeholders with deep pockets.

In the last one decade alone, the valuation of the tournament has increased three times, propelling the Board of Control for Cricket in India’s (BCCI) income from the tournament four-fold. Since 2008, IPL’s telecast rights and its title sponsorship deals have increased by nearly 12 times. These numbers are testimonials to IPL’s brand value, which has bolstered the faith of investors.

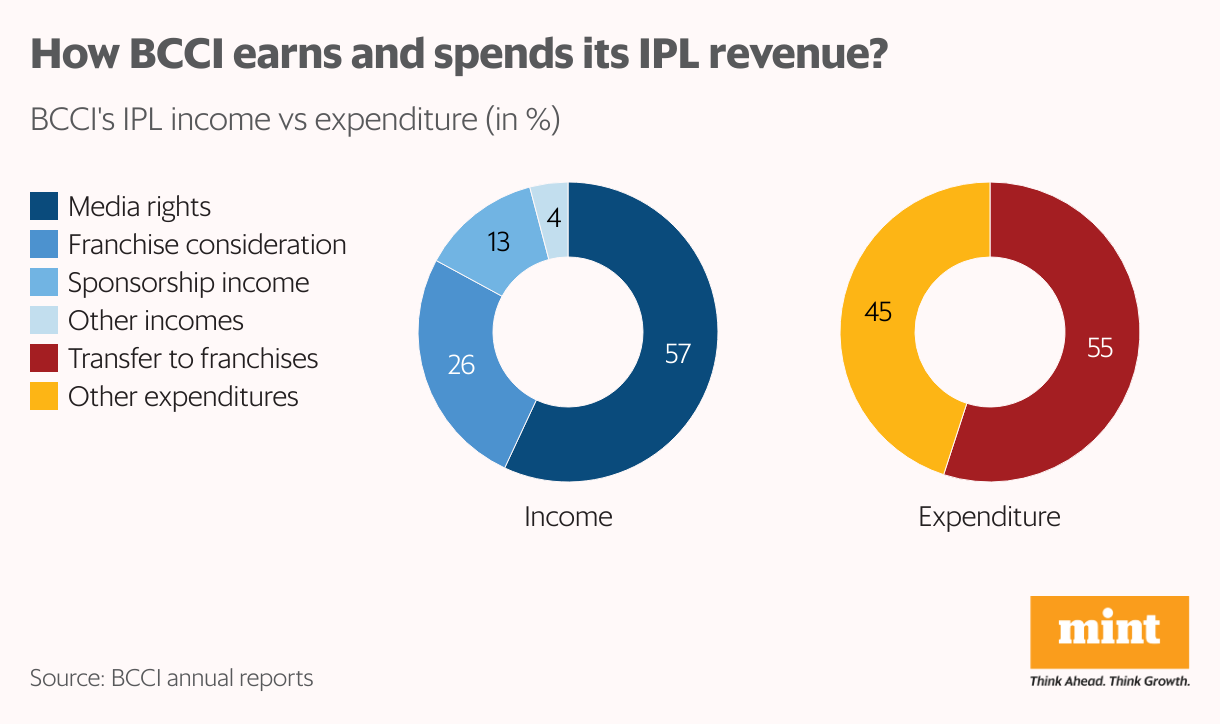

The league’s two main stakeholders—BCCI and the franchises—are also the primary benefactors of the revenue generated by IPL. A quid pro quo arrangement governs the revenue sharing between the two sides: while BCCI shares a part of its earnings from selling media rights and sponsorship with the franchise, the IPL teams, on the other hand, transfer a substantial amount to the Board from franchise auction and annual fees. In the following charts, we break down the various revenue streams that fuel BCCI’s earnings from the IPL.

Also Read | Jio Cinema-Disney+ Hotstar merger: Why JioHotstar needs batting depth beyond the IPL

Cash streams

IPL offers three main sources of revenue for BCCI: media rights, transfers of revenue from IPL teams, and sponsorship. These three streams contribute more than 95% to BCCI’s total income from IPL: selling media rights (57%), income from franchises (26%) and sponsorship deals (13%). More than half (55%) of BCCI’s total expenditure on IPL goes as transfer to franchises.

Prime-time phenomenon

For the inaugural edition of IPL in 2008, the Board sold telecast rights to the consortium of India’s Sony Television network and the Singapore-based World Sports Group (WSG) for ₹4,048 crore, for a period of 10 years. Within a year, the Board re-negotiated the deal with the consortium hiking the amount to ₹8,200 crore for the remaining nine years.

Today, the telecast rights of the tournament are split among three companies: Disney+Star, Viacom18 and Times Internet. The deal struck in 2022 for the next five years made BCCI richer by a whopping ₹48,391 crore, nearly 12 times over the value of the inaugural deal.

Also Read: Royal Challengers Bengaluru plans to expand its cricketing ecosystem

Mutual gains

The second-biggest source of BCCI’s IPL earnings is from franchise considerations: this is the amount transferred by IPL teams to the Board in lieu of annual fee, franchise auction money, etc. In 2023, the 10 IPL teams transferred a share of their revenues, amounting to nearly ₹1,731 crore, to the Board.

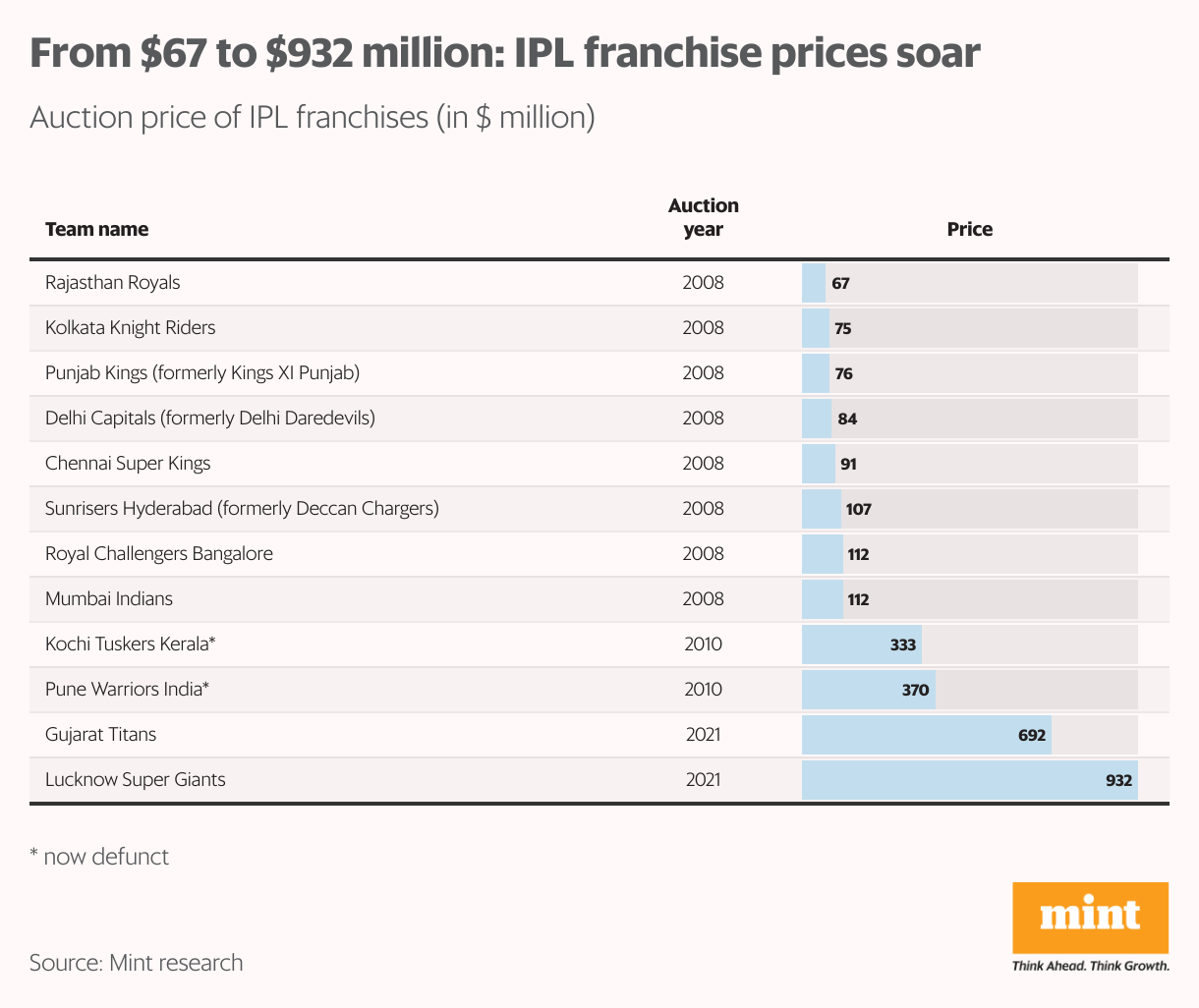

Auction of the team constitutes a major component of BCCI’s IPL earnings. Till now, the Board has auctioned off 12 teams, earning it $3 billion. (Two teams—Kochi Tuskers Kerala and Pune Warriors—were discontinued a year after their inaugural season).

The name game

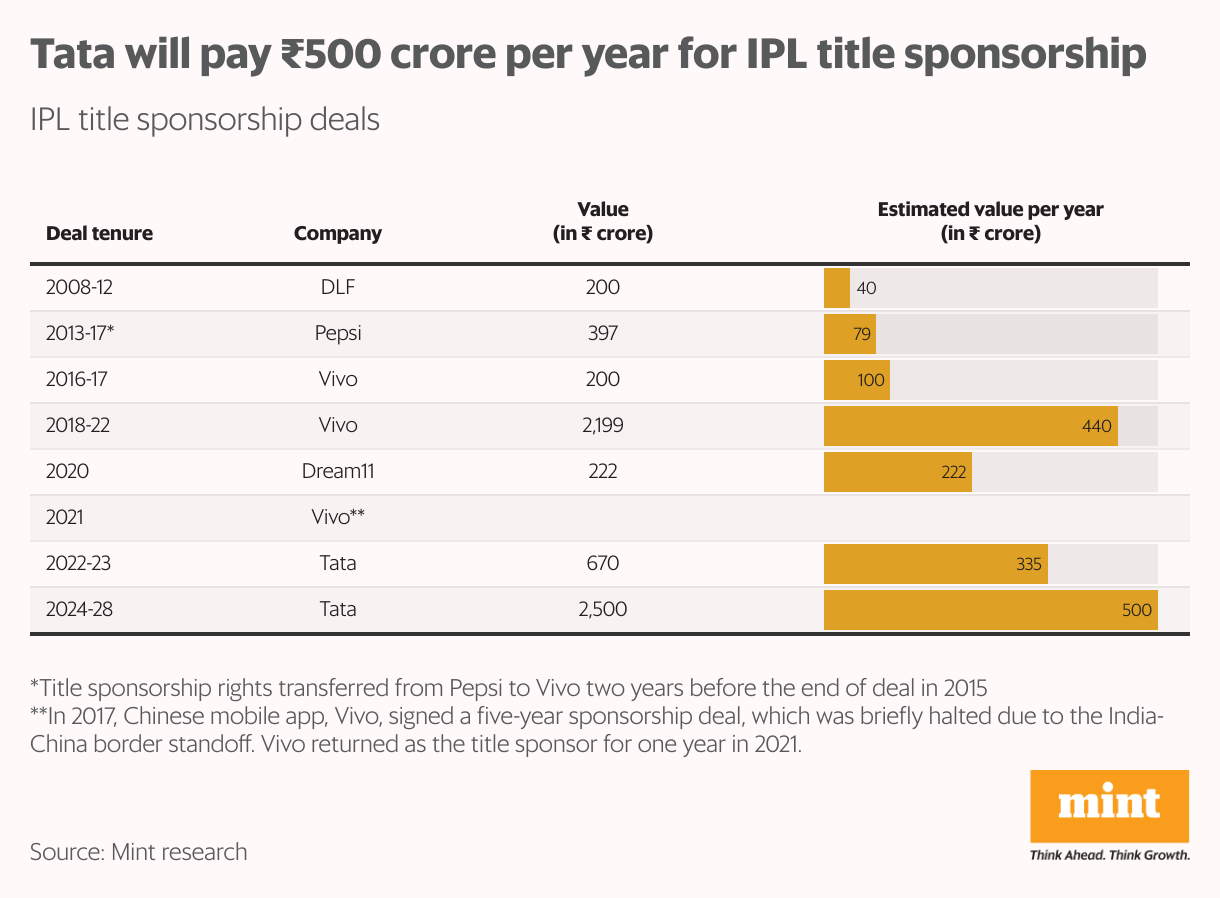

Title rights, where a company pays to have its name associated with the IPL brand, has swelled from an impressive ₹200 crore in 2008 to an astounding ₹2,500 crore in 2024.

In 2008, DLF was the first company to buy IPL’s title rights for ₹200 crore, translating to ₹40 crore per year. In January 2024, Tata extended its two-year contract, ending in 2023, for the next five years, amounting to ₹500 crore per year.

As the next edition approaches, expect more records to be set, both sporting and financial.

Also Read: Kumbh, cricket and concerts give Indian tourism a high. So why are the stocks down?

IPL valuation,Indian Premier League,Indian cricket board,BCCI,BCCI revenue,media rights,franchise fees,Sony,Disney Star,Viacom18,IPL viewership

#IPLs #soaring #valuation #fuels #Indian #cricket #boards #growing #revenue