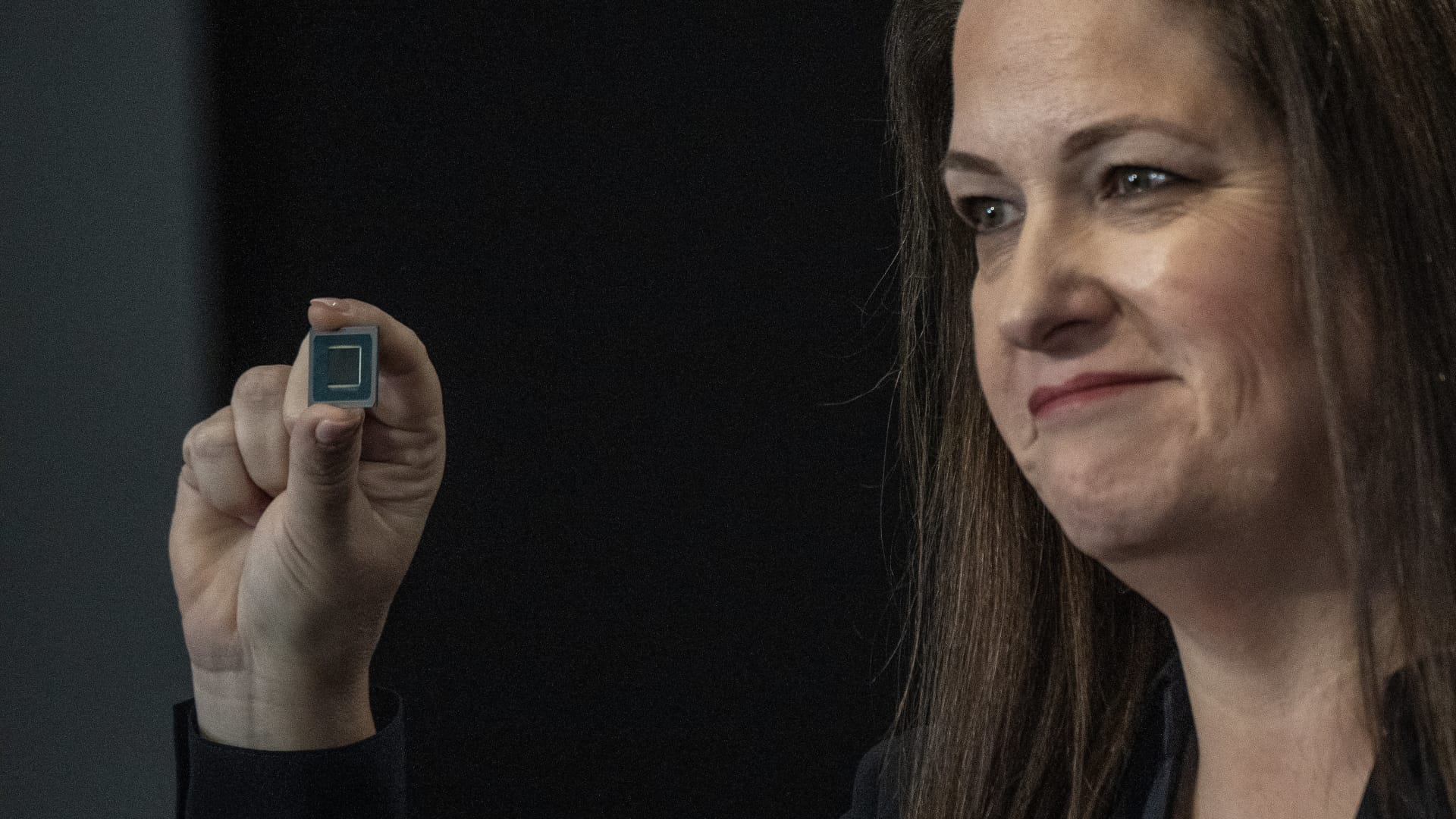

Victor J. Blue | Bloomberg | Getty Images

Here’s how the company did in the fourth quarter compared with LSEG estimates:

- Earnings per share: 13 cents adjusted vs. 12 cents expected

- Revenue: $14.26 billion vs. $13.81 billion expected

Intel’s revenue declined for a third straight quarter, decreasing 7% from a year earlier, according to a statement. The company’s net loss for the quarter totaled $126 million, or 3 cents per share, compared with net income of $2.67 billion, or 63 cents per share, in the same quarter a year ago.

It’s the chipmaker’s first earnings report since announcing the departure of Pat Gelsinger as CEO. Gelsinger, who took the help in CEO, had a brutal tenure, giving up market share to competitors and falling way behind in the artificial intelligence race while committing billions of dollars for manufacturing plants.

Intel appointed two interim co-CEOs, finance chief David Zinsner and Intel Products CEO Michelle Johnston Holthaus, to succeed Gelsinger.

“Dave and I are taking actions to enhance our competitive position and create shareholder value,” Johnston Holthaus was quoted as saying in Thursday’s release.

Adjusted results exclude stock-based compensation, acquisition-related adjustments and interest on an annulled fine from the European Commission.

Intel said it will report breakeven profit for the first quarter, with revenue of between $11.7 billion and $12.7 billion. The LSEG consensus was $12.87 billion in revenue and 9 cents in adjusted earnings per share.

Management pointed to seasonality, economic conditions and competition, and said clients are digesting inventory.

Intel’s Client Computing Group, which sells PC chips, produced $8.02 billion in revenue in the fiscal fourth quarter. Revenue was down 9% year over year but above the $7.84 billion consensus among analysts polled by StreetAccount.

The Data Center and Artificial Intelligence segment, which provides processors to cloud providers and corporate server farms, generated $3.39 billion in revenue. That was down 3% and inline with StreetAccount’s $3.38 billion consensus.

Intel’s Network and Edge unit contributed $1.62 billion in revenue, up 10% and above the $1.5 billion consensus from StreetAccount.

During the quarter, Intel finalized a $7.86 billion U.S. government grant to support manufacturing in four states.

The company expects volume chip production based on its 18A process technology in the second half of 2025, according to a presentation. Next-generation laptop chips carrying the code name Panther Lake will launch in the second half of the year, Intel said.

Before Thursday’s close Intel shares were down 1% for the year, while the S&P 500 index was up about 3%.

Executives will discuss the results with analysts on a conference call starting at 5 p.m. ET.

This is breaking news. Please check back for updates.

WATCH: Bernstein’s Stacy Rasgon talks Intel’s stock seeing best day since August

Breaking News: Earnings,Earnings,Intel Corp,Business,Technology,Breaking News: Technology,Enterprise,business news

#Intel #INTC #earnings #report