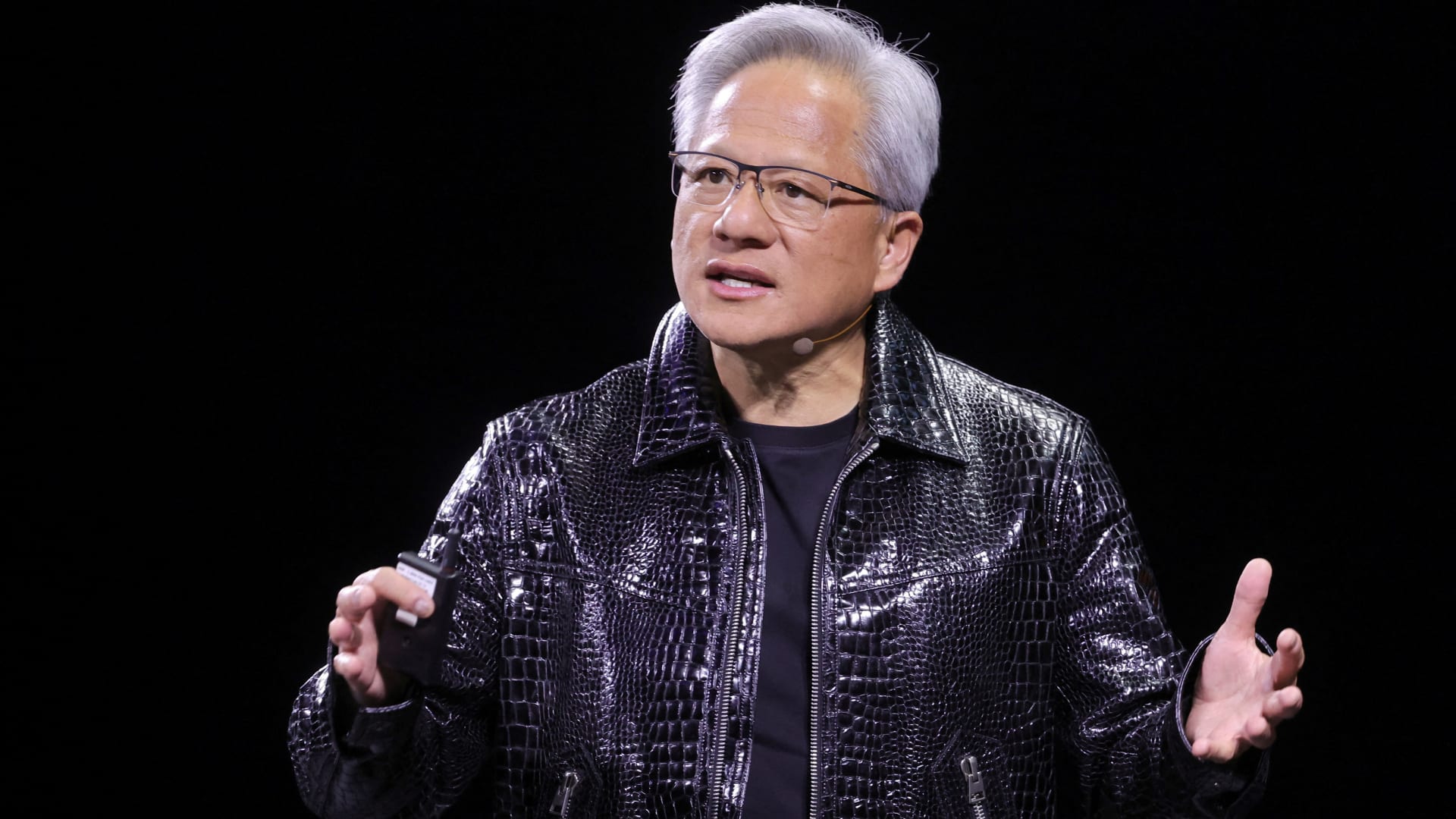

Steve Marcus | Reuters

The leading chipmaker slumped about 5% on Monday, building on last week’s losses as heavy selling continued across the tech sector. The popular artificial intelligence stock has shed about a fifth of its market cap since President Donald Trump’s inauguration.

The stock hit an intraday high of $153.13 on Jan. 7.

Tariff fears and growth concerns have rocked technology stocks, including Nvidia, over the last week, with the tech-heavy Nasdaq Composite dropping more than 4%. The Nasdaq traded at a six-month low Monday.

Many technology companies rely on parts and manufacturing overseas and new levies could push up prices. That’s also sparked worries of a U.S. recession, which Trump didn’t rule out over the weekend.

Tesla led the declines among the Magnificent Seven names, plummeting more than 9%. The Elon Musk-backed electric vehicle company has plunged 16% over the last week and shed nearly 44% since Trump took office in January. The stock is also coming off its longest weekly losing streak in history as a public company.

Economy,Technology,Taiwan Semiconductor Manufacturing Co Ltd,Taiwan Semiconductor Manufacturing Co Ltd,NVIDIA Corp,VanEck Semiconductor ETF,Broadcom Inc,ASML Holding NV,ASML Holding NV,Tesla Inc,Alphabet Inc,Apple Inc,Meta Platforms Inc,Microsoft Corp,Amazon.com Inc,Technology Select Sector SPDR Fund,Micron Technology Inc,Marvell Technology Inc,Breaking News: Markets,Markets,Enterprise,Breaking news,Breaking News: Technology,Breaking News: Economy,business news

#Nvidia #high #techled #selloff #hits #Magnificent