According to Huang, DeepSeek’s R1 model is “fantastic” because it is “the first open-sourced reasoning model.” He explained that the model breaks down problems step-by-step, is able to come up with different answers, and it can verify whether its answer is correct.

“This reasoning AI consumes 100 times more compute than a non-reasoning AI,” he said. “It was exactly the opposite, it was the exact opposite conclusion that everybody had.”

In late January, DeepSeek’s model triggered a massive sell-off in AI stocks, as investors feared the model could perform as well as top competitors using less energy and money. Nvidia plummeted 17% in one session to lose close to $600 billion, the largest ever single day drop for a U.S. company.

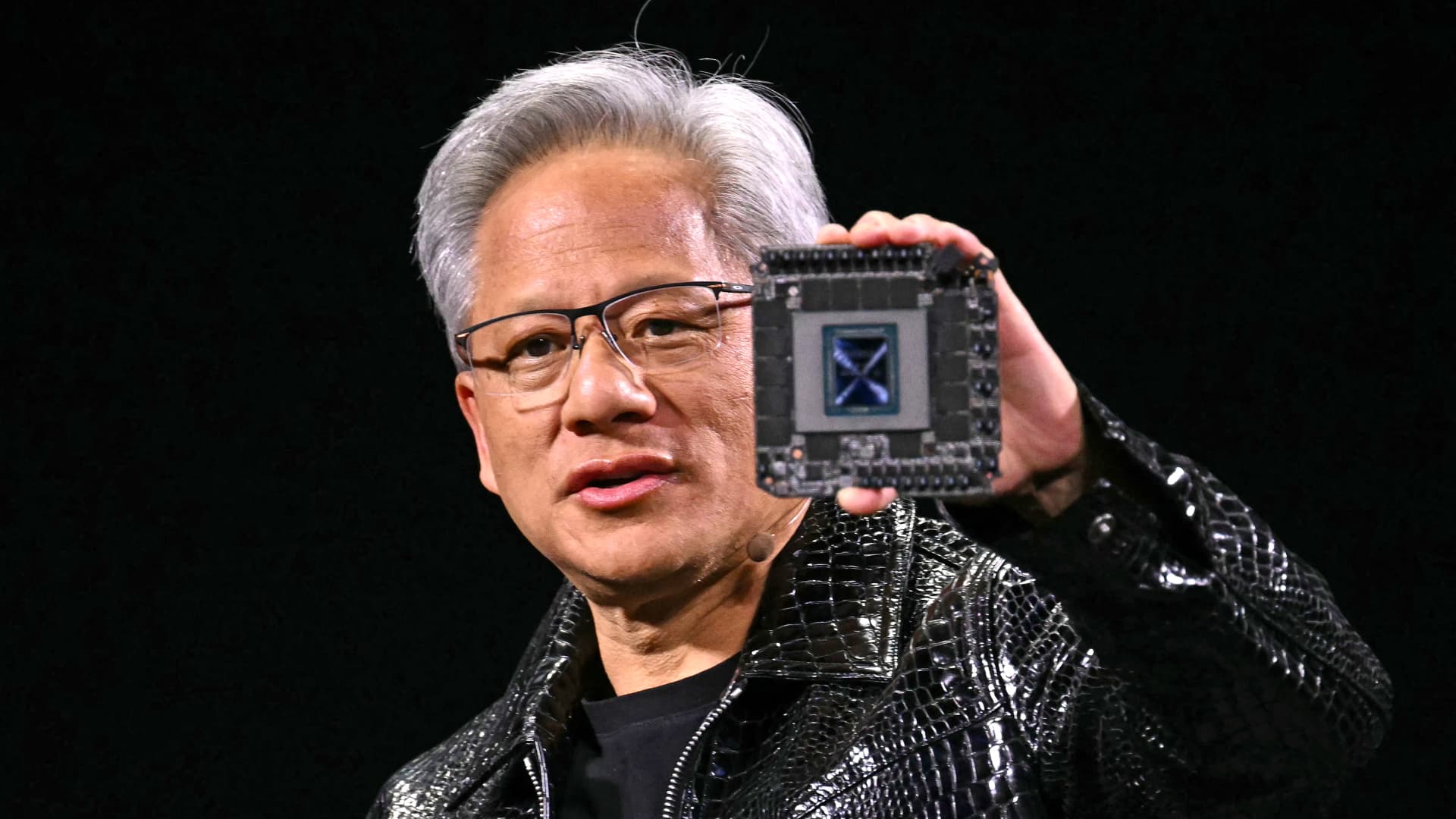

Huang also spoke about some of what his company has revealed so far at its conference, including new AI infrastructure for robotics and for the enterprise, highlighting partnerships with companies like Dell, HPE, Accenture, ServiceNow and CrowdStrike. He reflected broadly on the AI boom, noting the way hype has shifted from purely generative AI to reasoning models. He also predicted that the world’s computing capital expenditures seems on track to reach a trillion dollars by the end of the decade, and that the majority of that money will be used for AI.

“So, our opportunity as a percentage of a trillion dollars by the end of this decade is, is quite large,” Huang said. “We’ve got a lot of infrastructure to build.”

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Nvidia and CrowdStrike.

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com

CEO,CrowdStrike Holdings Inc,ServiceNow Inc,Accenture PLC,Hewlett Packard Enterprise Co,Dell Technologies Inc,NVIDIA Corp,Markets,Business,Investment strategy,Stock markets,Jim Cramer,business news

#DeepSeek #model #times #computing