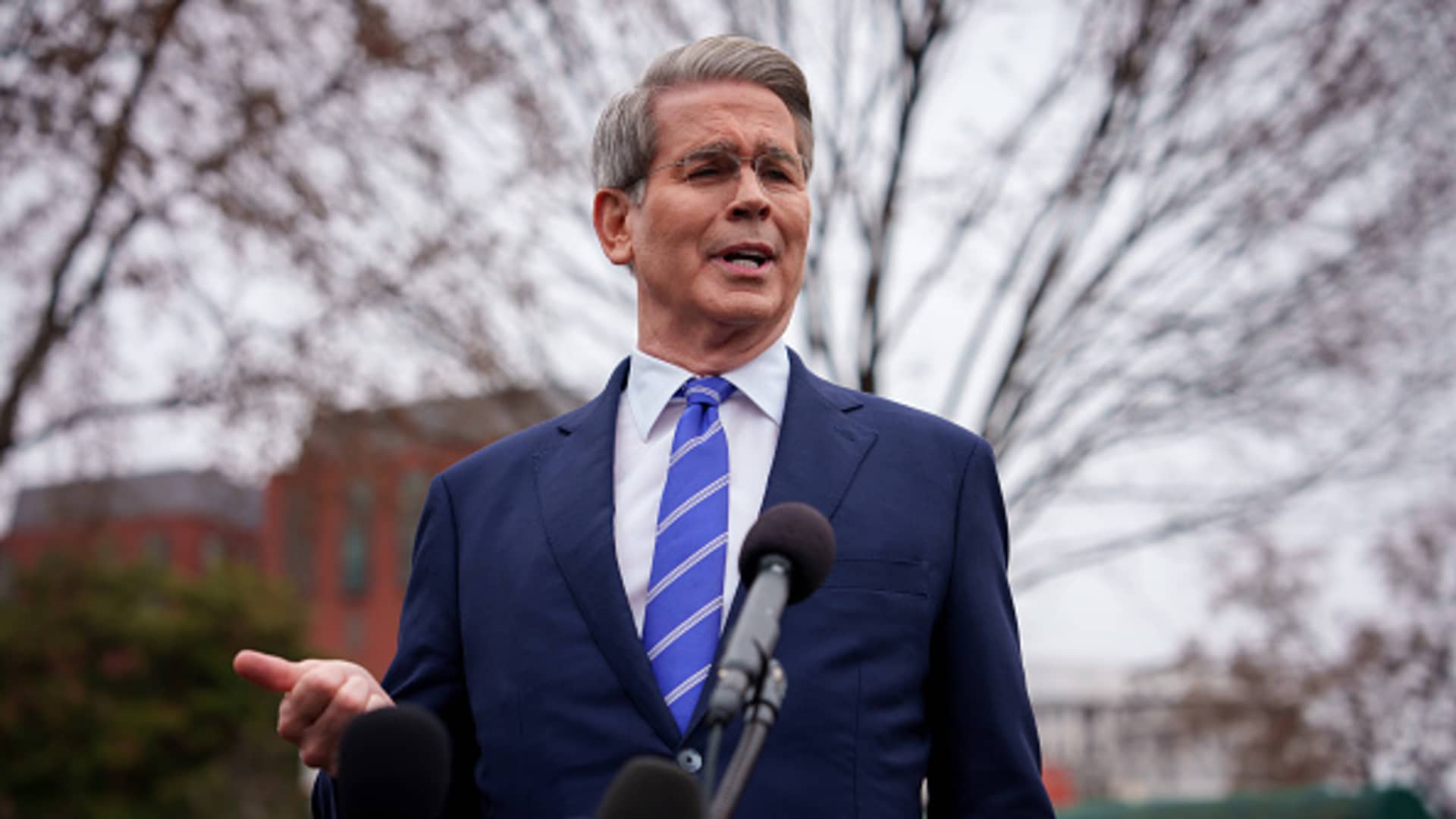

Andrew Harnik | Getty Images

“We’re focused on the real economy. Can we create an environment where there are long-term gains in the market and long-term gains for the American people?” Bessent said on CNBC’s “Squawk on the Street.” “I’m not concerned about a little bit of volatility over three weeks.”

The comments come with markets in a state of turmoil largely centered on President Donald Trump’s near-daily moves on tariffs against major U.S. trading partners such as Canada, Mexico and China. Major averages have moved toward correction territory, as the Dow Jones Industrial Average has lost more than 7% over the past month.

While Bessent said the administration is attentive to market moves, he predicted that both the real economy and markets would prosper over time.

“The reason stocks are a safe and great investment is because you’re looking over the long term. If you start looking at micro horizons, stocks become very risky. So we are focused over the medium-, long-term,” he said in the interview with CNBC’s Sara Eisen. “I can tell you that if we put proper policies in place, it’s going to lay the groundwork for a both real income gains and job gains and continued asset gains.”

Stocks again were volatile in morning trade, with the averages around even as Bessent spoke.

Earlier in the morning, the Bureau of Labor Statistics reported that wholesale inflation was flat in February, well below Wall Street expectations for a 0.3% increase. That followed a report Wednesday indicating that the consumer price rate had nudged lower as well, providing some welcome news amid concerns that the Trump tariffs would aggravate inflation.

“Maybe the inflation is getting under control and the market is going to have some confidence in that,” Bessent said.

Breaking News: Politics,Markets,Breaking News: Markets,Breaking News: Economy,Politics,Donald J. Trump,Dow Jones Industrial Average,business news

#Treasury #Secretary #Bessent #White #House #focused #real #economy #concerned #market #volatility